Networking & Collaboration in Entrepreneurship

This course is designed to explore the critical role of …

What you'll learn

Understand the importance of networking and collaboration in entrepreneurship.

Explore effective networking strategies for building professional relationships.

Learn how to identify potential collaborators and assess their compatibility.

Gain insights into the art of fostering collaboration and partnerships.

Analyze the ethical considerations in networking and collaboration.

Discuss the role of networking in accessing resources and funding opportunities.

Explore case studies of successful entrepreneurial collaborations.

Formulate strategies for leveraging networks for business growth.

Develop skills for effective communication and relationship-building.

Apply the principles of networking and collaboration to enhance entrepreneurial ventures.

Introduction to Investment Banking

Investment banking is a financial sector that plays a crucial …

What you'll learn

Introduction to the Investment Banking Industry: Familiarize with the role, significance, and structure of investment banks.

Services Provided by Investment Banks: Understand the full spectrum of services, including mergers and acquisitions, underwriting, sales and trading, and asset management.

Regulatory Environment: Learn about the regulatory landscape and how it shapes the operations of investment banks.

Equity and Debt Financing: Gain insights into how companies raise capital through equity and debt, and the role of investment banks in this process.

Mergers and Acquisitions (M&A): Introduce the concepts of M&A and the steps involved in an M&A transaction from both the buy-side and sell-side perspectives.

IPO Process: Understand the stages of an Initial Public Offering, from pre-IPO preparation to post-IPO market performance.

Financial Modeling and Valuation: Get introduced to the basics of financial modeling and valuation techniques used in investment banking.

Risk Management: Learn about the risk factors in investment banking and the tools used to manage and mitigate these risks.

Investment Banking Strategy: Familiarize with the strategic considerations in investment banking, including deal origination and client relationship management.

Career Paths in Investment Banking: Explore the various roles within an investment bank and the career paths available.

Introduction to Financial Planning and Analysis (FP&A)

Financial Planning and Analysis (FP&A) plays a pivotal role in …

What you'll learn

Understanding FP&A: Define FP&A within the context of corporate finance and explain its strategic importance to organizations.

Financial Statement Analysis: Learn to analyze and interpret financial statements for better planning and forecasting.

Budgeting Basics: Grasp the fundamentals of budgeting, including the creation and management of effective budget plans.

Forecasting Techniques: Understand various financial forecasting methods and their applications in FP&A.

Variance Analysis: Learn to perform variance analysis and its significance in the FP&A process.

Capital Budgeting and Investment Appraisal: Introduce concepts like Net Present Value (NPV) and Internal Rate of Return (IRR) for project evaluation.

Working Capital Management: Understand the management of working capital and its impact on a company’s liquidity and profitability.

Financial Modeling: Gain basic insights into creating financial models for scenario analysis and decision-making.

Key Performance Indicators (KPIs): Identify and evaluate KPIs relevant to FP&A activities.

Strategic Planning: Understand how FP&A contributes to long-term strategic planning within an organization.

Introduction to Corporate Finance

Corporate finance plays a central role in managing a company’s …

What you'll learn

Understand the Role of Corporate Finance: Define corporate finance and understand its significance in the corporate structure.

Grasp the Concept of Financial Statements: Learn how to interpret balance sheets, income statements, and cash flow statements.

Identify Sources of Business Financing: Explore various financing options for businesses, including debt, equity, and internal financing.

Assess Investment Decisions with Capital Budgeting: Introduce the principles of capital budgeting and understand different investment appraisal methods.

Learn the Time Value of Money (TVM): Understand the basic principles of TVM and its application in corporate finance.

Understand Risk and Return: Learn how to measure risk and its relationship to expected returns.

Explore the Weighted Average Cost of Capital (WACC): Gain an understanding of how companies assess the cost of capital.

Learn about Dividend Policy: Introduce various theories related to dividend policies and their practical implications.

Valuation of Securities: Learn the basics of valuing stocks and bonds.

Examine the Mergers & Acquisitions (M&A) Process: Provide an overview of the M&A process, including due diligence and valuation.

International Trade Policies and Regulations

Trade policies and regulations are guidelines and laws governing international …

What you'll learn

Basics of International Trade: Understanding the fundamental concepts and importance of international trade.

Trade Policies: Explore different types of trade policies and their impacts on international business.

Regulatory Frameworks: Understanding the international regulatory frameworks that govern global trade.

Trade Agreements: Study various international trade agreements and their roles.

Tariffs and Non-Tariff Barriers: Examine the use and impact of tariffs and non-tariff barriers in trade.

Global Trade Organizations: Learn about the role of global trade organizations like the WTO.

Economic Integration: Understand different forms of economic integration and their implications for trade.

Trade Ethics and Standards: Discuss the ethical considerations and standards in international trade.

Emerging Trends: Analyze current trends and future directions in international trade policies.

Compliance and Enforcement: Learn about compliance with trade policies and enforcement mechanisms.

Cross-Border Mergers and Acquisitions (M&A) Trends

Cross-border mergers and acquisitions (M&A) involve the acquisition or merging …

What you'll learn

Understanding Cross-Border M&A

Key Trends in Cross-Border M&A

Cultural and Regulatory Considerations

Integration and Synergy

Risk Management in Cross-Border M&A

Case Studies of Successful Cross-Border M&A

Cross-Cultural Communication and Leadership

Financial and Legal Aspects

Strategic Planning for Cross-Border M&A

Future Outlook and Emerging Trends

Introduction to Innovation Management

Innovation is the process of introducing new ideas, methods, or …

What you'll learn

Understanding Innovation

The Innovation Management Process

Role of Leadership in Innovation

Innovative Thinking and Creativity

Technology and Innovation

Open Innovation and Collaboration

Managing Risks in Innovation

Business Model Innovation

Innovation Metrics and Evaluation

Cultural Aspects of Innovation

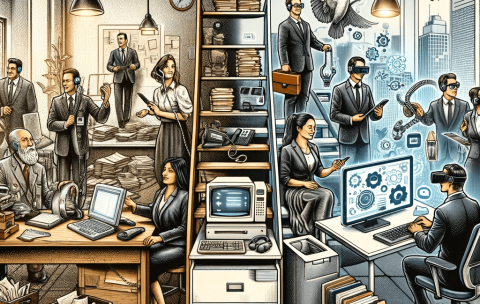

Introduction to Digital Transformation

Digital transformation refers to the integration of digital technology into …

What you'll learn

Understanding Digital Transformation

The Digital Landscape

Components of Digital Transformation

Impact on Business Models

Customer-Centric Approach

Data-Driven Decision Making

Technological Enablers

Challenges and Risks

Cultural Shift in Organizations

Future Trends in Digital Transformation